The 4 Answers Financial Marketers Need to Make the Case for Social Selling

Forward-thinking marketers understand the power of social media at all stages of their marketing funnel. From awareness and consideration to loyalty and even advocacy, social and digital channels can and do inform purchase decisions. Financial institutions are catching on — more than 90% of the 50 largest banks are currently on Facebook, and 88% have active Twitter accounts — but being on social media doesn’t equate to a strong social media strategy. Today’s digital market requires an integrated strategy that meets target audiences throughout the buyer’s journey. This means investing in paid social campaigns alongside organic and driving deeper relationships with customers through social selling.

Sounds easy, right? While marketers may understand the strategies and costs associated with modern social success, senior decision makers may still need educating and persuading. That’s why it’s essential to be able to effectively communicate the benefits of integrated social media strategies. In addition to intangible benefits like building trust and humanizing your brand, both organic and paid social selling strategies offer metrics that enable marketers to prove value.

After all, people buy from people. So if you’re ready to advocate for an expanded social media strategy, start by asking yourself these questions. Not only will they help you decide on your strategic priorities, but they will also show you how to articulate the value of social media strategies to the people holding the budget strings. To prove the value of social media in financial services and get buy-in from senior leaders, marketers must ask themselves these questions:

Does Our Social Media Marketing Drive ROI?

Expanding a social media strategy often means increased spending — so you must be able to show decision makers the value of social. While financial marketers are already advocates — they know the power of paid social media efforts and have seen it in action — other leadership may not have that knowledge. It’s up to marketing teams to connect the dots on how their efforts are driving business results, and that means providing a strong argument based on metrics and concrete benefits.

Data tells a powerful story, so let it guide the conversation. And to further strengthen your case for expanded social media strategies, make sure to highlight these benefits:

• Targeting

While organic content is important, leaders must understand that it’s not enough to impact the bottom line without paid support. Paid social media gives more flexibility than organic content — you can target specific customer subsets, or even new audience bases, allowing for greater personalization and a higher ROI. It’s all about delivering relevant content to the right consumers at the right time.

• Feedback

Feedback may not always impact the bottom line, but social media itself does offer a direct line to consumers. With the lines of communication open, it becomes easier to listen and learn about their wants, needs, and interests. An open-ended post, for instance, can encourage comments, which provide qualitative feedback on any given topic. This will improve the trust in your institution; customers (and their followers!) will see the commitment to providing an ever-improving experience.

• Conversion

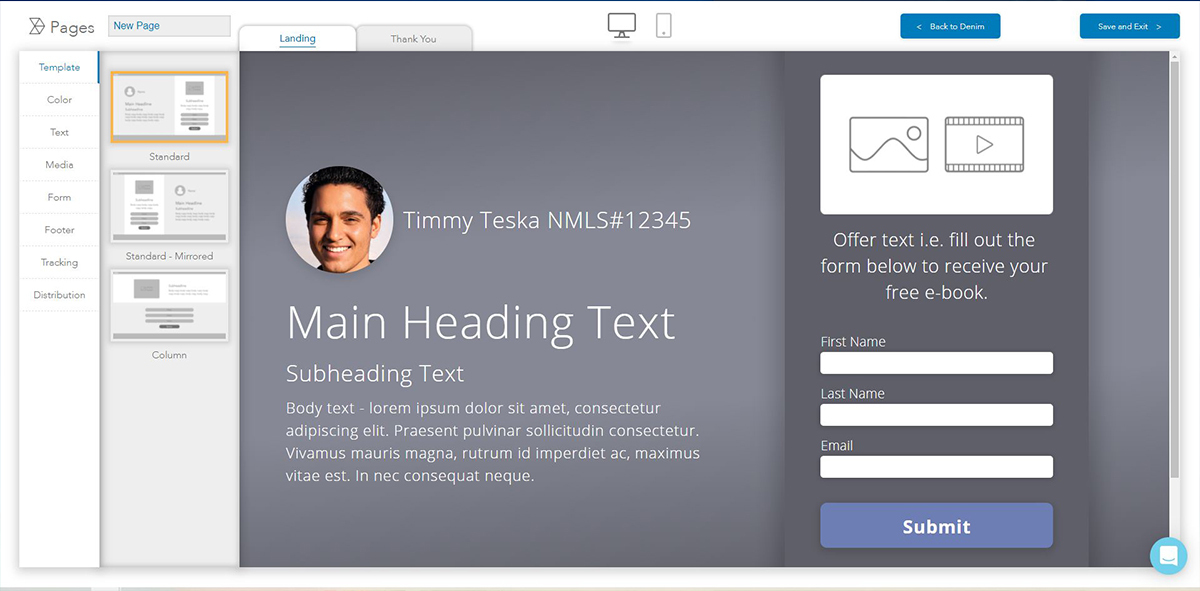

Social media is about more than likes: If you’re providing links on social media (and you should), you’re creating conversion opportunities. Direct consumers to a landing page — from there, you can collect lead information. All that’s left is a follow-up. If that landing page has a form, track completion rates. The icing on top? These interactions are all measurable. Prove value by comparing these metrics with traditional tactics. When did a leader ever see a recorded, data-backed conversion metric from a billboard?

• Efficiency

Measuring social media marketing ROI, like most analytics, requires technology — and the right technology, at that. Spreadsheets simply won’t cut it, and they’re not as accurate or efficient as the tools that fintech partners offer. That’s why the Denim Social platform was built with financial institutions in mind. Its analytics capabilities allow for a more efficient means of capturing results while also centralizing information. Data is readily available, which can simplify and improve the approval workflow. Improvements to the workflow process have been shown to free up 20% to 30% of employees’ time — so bring that statistic to decision makers to prove its necessity.

How Do You Use Social Media Analytics to Make Your Case?

Expanding marketing strategies means collecting more data, and that necessitates a robust social media management tool. Gathering data on any social media marketing campaign affords you the opportunity to measure its overall performance and gives you clear-cut evidence to support business measures related to those efforts.

Of course, data should be gathered based on specific criteria. Meaningful insights come from specific measurable goals related to your campaign and the goals of company decision makers. While the objectives of any social media strategy for financial services will vary from one institution to the next, any marketing effort can benefit from optimizing strategy through social media ROI metrics.

Use metrics to hone your messaging and audience. Every social media marketing post is a learning opportunity about what resonates with your audience. Analytics show what topics drive engagement, what calls to action inspire clicks, and so on. Then, fine-tune subsequent posts based on your findings. Mastering social is an iterative process. When speaking with upper management, highlight how this process delivers greater value over time by continuously evolving.

As you optimize your messaging, look to target audiences. Social media, and paid social in particular, allows you to target subsets of consumers. Vary your messaging and content, and you begin to understand what connects with whom. This allows you to maximize social media spend going forward — you’re not wasting time and effort putting messaging in front of an uninterested audience. When decision makers want to reach specific audiences, outline how putting money toward paid ad campaigns makes that happen.

When you’re looking at your own metrics, be sure to pay attention to where the customer journey is going. Failure to guide customers to a landing page and other lead-generating tools will lead to dead ends, which isn’t the best use of these channels. Trackable links and analytics help marketers recognize the best avenues for using social media posts to capture leads that translate into sales. If you aren’t effectively working toward leads, it’ll be difficult to defend the necessity of your budget.

Finally, don’t measure your ROI too soon. If you’re going to connect the value of social to your broader business objectives, you need to sync your measurement time with your sales cycle or risk misunderstanding (and likely underestimating) the impact of social. Help leadership understand that ROI isn’t a one-and-done and it’s not instantaneous. That way, you’re guiding their expectations to the bigger picture of what your social media strategy is doing.

Troves of data are available from social media channels, and you’ll need the right technology to organize the information and arrive at a set of objectives that align with your larger business goals. The right measurement tool can build the confidence digital marketers need to foster social media marketing ROI success.

What’s the Cost of Getting Social Media Compliance Wrong?

Social media compliance for financial institutions can feel challenging, especially today. SEC Chairman Gary Gensler has brought increased scrutiny to social media since his appointment, and it’s understandable for institutions to want to pull back efforts to mitigate compliance risks. Make sure your executives understand that this method loses more than they gain.

Consider that customers are increasingly using digital methods to meet financial needs. Can anyone afford to lose out on that audience base? You won’t reach new customers, and you’re losing valuable social selling opportunities with the ones you have. Social selling influences half of revenue for 14 major industries — and financial services is one of them.

Rather than scaling back social media efforts (and in the process, your revenue), work to mitigate compliance risks. When senior management airs concerns over compliance, counter with technology to automate compliance monitoring. Denim Social was built for compliance, so you can focus less on worrying if you’re compliant and more on fostering leads.

With Denim Social, you can use numerous tools that can help in ensuring:

• Protection. Problematic posts never see the light of day, as our platform not only establishes an approval workflow but also flags posts containing questionable keywords or phrases even before the review process.

• Education. Our platform can serve as an ongoing compliance education tool. Team members receive almost immediate feedback and can test the equipped filters to understand what might cause regulatory trouble.

• Enablement. Denim Social allows for the creation content libraries and curated, pre-approved posts. Team members can pull from these resources without the need for approvals, adding speed and efficiency to the process.

• Record-keeping. The potential of an audit hangs over every financial institution. Our platform archives all social media posts and interactions. It even does the same with comments. If regulators come knocking, you’ll have a report in no time.

• Notifications. Should a team member try to send a post through the approval process with a prohibited keyword or phrase, those flags send a notification directly to the individual. Employees quickly learn what can and cannot be posted.

• Profile locks. Rules can be built within the platform that can prevent team members from posting problematic content, helping to quell worries about social media compliance. The goal is to provide the controls necessary to avoid issues.

• Editing. Admins can edit or delete team members’ posts, comments, or direct messages right from the platform — across any connected social channel. In fact, the process is automated when prohibited keywords or phrases hit the network.

Social media compliance for financial institutions shouldn’t be more complicated than any other compliance for your operation. It all comes down to your choice of technology, and Denim Social has the experience and tools you need to make it a breeze.

What Do We Need in a Fintech Partner?

The social media marketing needs of financial institutions are unique. You’re not necessarily selling a product or a service but a relationship with a qualified professional, which calls for authenticity and empathy to establish a sense of trust. The tactics used by “traditional” brands simply aren’t as impactful in the financial services space.

Beyond that, social media compliance is complex. Without industry knowledge, it can be difficult for a marketing agency to navigate the nuances set by FINRA. Your fintech partner should fully appreciate the regulatory constraints and respect the concerns of your financial institution while still understanding how to drive real value with your social media strategy.

However, according to Cornerstone’s “What’s Going On In Banking 2021” report, financial institutions aren’t having much success finding these qualified and attentive partners, noting that FI “boards will tire of not seeing results [from fintech partnerships]." Executives are relying on your expertise to identify fintech partners with a proven ability to collaborate and create solutions. And because boards may be wary of partners, you must be able to outline exactly how that partner will help you reach your goals. Help executives understand these benefits.

• Customized onboarding.

Denim Social customizes our onboarding process to meet your specific needs, so executives know they’re getting an experience tailor-made for the company. No questions are left unanswered — we walk alongside you to always offer an explanation. On top of that, our team will help you craft the communication necessary to get employees to use the platform. Emails, messaging, toolkits, and more are available to encourage adoption, so upper-level management knows they’re investing in a tool that will see widespread use.

• Team training.

Depending on your size and needs, we provide kickoff and regular training to help team members make the most of the platform so that decision makers can rest easy knowing our software isn’t being underutilized. We can also provide train-the-trainer sessions to move training internal, and our recently launched Academy can help marketers become certified on our platform.

• Strategy consultation.

Our customer success team can help you identify tactics to move the needle on your social media strategy. Just ask, and we’ll provide best practices and industry-relevant comparisons to inform your tactics and optimize your social selling implementation.

• Content libraries.

We work directly with your institution and UpContent to ensure you can create a customized content library that matches the specific needs of your business and your customers.

In order to optimize a social media strategy, FI leaders and marketers must be able to sustain compliance at scale and understand social media measurement and analytics to see ROI. When you understand your metrics, you can bring that knowledge to decision makers, too. They’ll see the value you bring to the brand and associates (and match that value when it’s time to make budgets). Trusted fintech partners with dedicated customer success teams can help.

Bottom line: Social media is hard, but marketers don’t have to do it alone. With Denim Social, they have dedicated team members they can call to help.

Get in touch with us today to schedule a demo!

The 4 Answers Financial Marketers Need to Make the Case for Social Selling

Forward-thinking marketers understand the power of social media at all stages of their marketing funnel. From awareness and consideration to loyalty and even advocacy, social and digital channels can and do inform purchase decisions. Financial institutions are catching on — more than 90% of the 50 largest banks are currently on Facebook, and 88% have active Twitter accounts — but being on social media doesn’t equate to a strong social media strategy. Today’s digital market requires an integrated strategy that meets target audiences throughout the buyer’s journey. This means investing in paid social campaigns alongside organic and driving deeper relationships with customers through social selling.

Sounds easy, right? While marketers may understand the strategies and costs associated with modern social success, senior decision makers may still need educating and persuading. That’s why it’s essential to be able to effectively communicate the benefits of integrated social media strategies. In addition to intangible benefits like building trust and humanizing your brand, both organic and paid social selling strategies offer metrics that enable marketers to prove value.

After all, people buy from people. So if you’re ready to advocate for an expanded social media strategy, start by asking yourself these questions. Not only will they help you decide on your strategic priorities, but they will also show you how to articulate the value of social media strategies to the people holding the budget strings. To prove the value of social media in financial services and get buy-in from senior leaders, marketers must ask themselves these questions:

Does Our Social Media Marketing Drive ROI?

Expanding a social media strategy often means increased spending — so you must be able to show decision makers the value of social. While financial marketers are already advocates — they know the power of paid social media efforts and have seen it in action — other leadership may not have that knowledge. It’s up to marketing teams to connect the dots on how their efforts are driving business results, and that means providing a strong argument based on metrics and concrete benefits.

Data tells a powerful story, so let it guide the conversation. And to further strengthen your case for expanded social media strategies, make sure to highlight these benefits:

• Targeting

While organic content is important, leaders must understand that it’s not enough to impact the bottom line without paid support. Paid social media gives more flexibility than organic content — you can target specific customer subsets, or even new audience bases, allowing for greater personalization and a higher ROI. It’s all about delivering relevant content to the right consumers at the right time.

• Feedback

Feedback may not always impact the bottom line, but social media itself does offer a direct line to consumers. With the lines of communication open, it becomes easier to listen and learn about their wants, needs, and interests. An open-ended post, for instance, can encourage comments, which provide qualitative feedback on any given topic. This will improve the trust in your institution; customers (and their followers!) will see the commitment to providing an ever-improving experience.

• Conversion

Social media is about more than likes: If you’re providing links on social media (and you should), you’re creating conversion opportunities. Direct consumers to a landing page — from there, you can collect lead information. All that’s left is a follow-up. If that landing page has a form, track completion rates. The icing on top? These interactions are all measurable. Prove value by comparing these metrics with traditional tactics. When did a leader ever see a recorded, data-backed conversion metric from a billboard?

• Efficiency

Measuring social media marketing ROI, like most analytics, requires technology — and the right technology, at that. Spreadsheets simply won’t cut it, and they’re not as accurate or efficient as the tools that fintech partners offer. That’s why the Denim Social platform was built with financial institutions in mind. Its analytics capabilities allow for a more efficient means of capturing results while also centralizing information. Data is readily available, which can simplify and improve the approval workflow. Improvements to the workflow process have been shown to free up 20% to 30% of employees’ time — so bring that statistic to decision makers to prove its necessity.

How Do You Use Social Media Analytics to Make Your Case?

Expanding marketing strategies means collecting more data, and that necessitates a robust social media management tool. Gathering data on any social media marketing campaign affords you the opportunity to measure its overall performance and gives you clear-cut evidence to support business measures related to those efforts.

Of course, data should be gathered based on specific criteria. Meaningful insights come from specific measurable goals related to your campaign and the goals of company decision makers. While the objectives of any social media strategy for financial services will vary from one institution to the next, any marketing effort can benefit from optimizing strategy through social media ROI metrics.

Use metrics to hone your messaging and audience. Every social media marketing post is a learning opportunity about what resonates with your audience. Analytics show what topics drive engagement, what calls to action inspire clicks, and so on. Then, fine-tune subsequent posts based on your findings. Mastering social is an iterative process. When speaking with upper management, highlight how this process delivers greater value over time by continuously evolving.

As you optimize your messaging, look to target audiences. Social media, and paid social in particular, allows you to target subsets of consumers. Vary your messaging and content, and you begin to understand what connects with whom. This allows you to maximize social media spend going forward — you’re not wasting time and effort putting messaging in front of an uninterested audience. When decision makers want to reach specific audiences, outline how putting money toward paid ad campaigns makes that happen.

When you’re looking at your own metrics, be sure to pay attention to where the customer journey is going. Failure to guide customers to a landing page and other lead-generating tools will lead to dead ends, which isn’t the best use of these channels. Trackable links and analytics help marketers recognize the best avenues for using social media posts to capture leads that translate into sales. If you aren’t effectively working toward leads, it’ll be difficult to defend the necessity of your budget.

Finally, don’t measure your ROI too soon. If you’re going to connect the value of social to your broader business objectives, you need to sync your measurement time with your sales cycle or risk misunderstanding (and likely underestimating) the impact of social. Help leadership understand that ROI isn’t a one-and-done and it’s not instantaneous. That way, you’re guiding their expectations to the bigger picture of what your social media strategy is doing.

Troves of data are available from social media channels, and you’ll need the right technology to organize the information and arrive at a set of objectives that align with your larger business goals. The right measurement tool can build the confidence digital marketers need to foster social media marketing ROI success.

What’s the Cost of Getting Social Media Compliance Wrong?

Social media compliance for financial institutions can feel challenging, especially today. SEC Chairman Gary Gensler has brought increased scrutiny to social media since his appointment, and it’s understandable for institutions to want to pull back efforts to mitigate compliance risks. Make sure your executives understand that this method loses more than they gain.

Consider that customers are increasingly using digital methods to meet financial needs. Can anyone afford to lose out on that audience base? You won’t reach new customers, and you’re losing valuable social selling opportunities with the ones you have. Social selling influences half of revenue for 14 major industries — and financial services is one of them.

Rather than scaling back social media efforts (and in the process, your revenue), work to mitigate compliance risks. When senior management airs concerns over compliance, counter with technology to automate compliance monitoring. Denim Social was built for compliance, so you can focus less on worrying if you’re compliant and more on fostering leads.

With Denim Social, you can use numerous tools that can help in ensuring:

• Protection. Problematic posts never see the light of day, as our platform not only establishes an approval workflow but also flags posts containing questionable keywords or phrases even before the review process.

• Education. Our platform can serve as an ongoing compliance education tool. Team members receive almost immediate feedback and can test the equipped filters to understand what might cause regulatory trouble.

• Enablement. Denim Social allows for the creation content libraries and curated, pre-approved posts. Team members can pull from these resources without the need for approvals, adding speed and efficiency to the process.

• Record-keeping. The potential of an audit hangs over every financial institution. Our platform archives all social media posts and interactions. It even does the same with comments. If regulators come knocking, you’ll have a report in no time.

• Notifications. Should a team member try to send a post through the approval process with a prohibited keyword or phrase, those flags send a notification directly to the individual. Employees quickly learn what can and cannot be posted.

• Profile locks. Rules can be built within the platform that can prevent team members from posting problematic content, helping to quell worries about social media compliance. The goal is to provide the controls necessary to avoid issues.

• Editing. Admins can edit or delete team members’ posts, comments, or direct messages right from the platform — across any connected social channel. In fact, the process is automated when prohibited keywords or phrases hit the network.

Social media compliance for financial institutions shouldn’t be more complicated than any other compliance for your operation. It all comes down to your choice of technology, and Denim Social has the experience and tools you need to make it a breeze.

What Do We Need in a Fintech Partner?

The social media marketing needs of financial institutions are unique. You’re not necessarily selling a product or a service but a relationship with a qualified professional, which calls for authenticity and empathy to establish a sense of trust. The tactics used by “traditional” brands simply aren’t as impactful in the financial services space.

Beyond that, social media compliance is complex. Without industry knowledge, it can be difficult for a marketing agency to navigate the nuances set by FINRA. Your fintech partner should fully appreciate the regulatory constraints and respect the concerns of your financial institution while still understanding how to drive real value with your social media strategy.

However, according to Cornerstone’s “What’s Going On In Banking 2021” report, financial institutions aren’t having much success finding these qualified and attentive partners, noting that FI “boards will tire of not seeing results [from fintech partnerships]." Executives are relying on your expertise to identify fintech partners with a proven ability to collaborate and create solutions. And because boards may be wary of partners, you must be able to outline exactly how that partner will help you reach your goals. Help executives understand these benefits.

• Customized onboarding.

Denim Social customizes our onboarding process to meet your specific needs, so executives know they’re getting an experience tailor-made for the company. No questions are left unanswered — we walk alongside you to always offer an explanation. On top of that, our team will help you craft the communication necessary to get employees to use the platform. Emails, messaging, toolkits, and more are available to encourage adoption, so upper-level management knows they’re investing in a tool that will see widespread use.

• Team training.

Depending on your size and needs, we provide kickoff and regular training to help team members make the most of the platform so that decision makers can rest easy knowing our software isn’t being underutilized. We can also provide train-the-trainer sessions to move training internal, and our recently launched Academy can help marketers become certified on our platform.

• Strategy consultation.

Our customer success team can help you identify tactics to move the needle on your social media strategy. Just ask, and we’ll provide best practices and industry-relevant comparisons to inform your tactics and optimize your social selling implementation.

• Content libraries.

We work directly with your institution and UpContent to ensure you can create a customized content library that matches the specific needs of your business and your customers.

In order to optimize a social media strategy, FI leaders and marketers must be able to sustain compliance at scale and understand social media measurement and analytics to see ROI. When you understand your metrics, you can bring that knowledge to decision makers, too. They’ll see the value you bring to the brand and associates (and match that value when it’s time to make budgets). Trusted fintech partners with dedicated customer success teams can help.

Bottom line: Social media is hard, but marketers don’t have to do it alone. With Denim Social, they have dedicated team members they can call to help.

Get in touch with us today to schedule a demo!

Where Are the Biggest Opportunities to Use Social Media in Financial Services?

Denim Social's Guide To Social Selling For Financial Services shows that most financial professionals — 83% of those surveyed — have a social media presence. It’s a great place to start, but having a profile is only the tip of the iceberg when it comes to what benefits financial institutions can enjoy from social media. Smart financial marketers and their teams should be optimizing their social selling efforts on every network to get the most out of what social media has to offer.

Customers are active in many other places online, so why not meet them there? After all, 79% of people look to social media for financial advice. By meeting customers where they are on the main 4 networks, financial institutions can stay top of mind and grow real, authentic connections. Let’s dive into what Instagram, LinkedIn, Twitter, and Facebook have to offer and how financial services marketers can best use each platform.

1. Instagram

As far as major social media platforms in financial services go, Instagram tops the list. While many financial professionals might not at first think of the photographic and visual network as prime business territory, its popularity makes it an excellent place to strengthen real relationships.

Instagram is one of the best ways to get in front of younger audiences, which is a worthwhile goal, considering that many Millennial customers will likely be on the search for new financial services providers as Baby Boomers pass their wealth on to the next generations. What's more, 90% of Instagram users follow at least one business account and 80% use the platform to discover new products.

Even better, getting started on Instagram is a breeze. Instagram ads also allow hyperlinks, so you can lead readers right from their feeds to your website with specific calls to action to learn more. Lead them to a personalized and well-designed landing page on your site, for instance, and you'll be drawing each follower who clicks through one big step closer to conversion.

2. LinkedIn

The majority of financial services providers already use LinkedIn, and there are many ways to make it perhaps the most successful social selling platform out of all the networks. Employees at institutions of all sizes and financial industries can use this professional network to cultivate thought leadership and educate their customers.

For financial services marketers, a brand profile is a necessary starting point. Getting the most out of the platform, however, requires activating your employees in a social selling strategy. They can share relevant content, such as videos and published articles from trusted media outlets, as well as engage with customers and prospects one-on-one via direct messaging to establish themselves as experts and build trusting relationships. People want to engage with other people, not with general brand pages. It’s no wonder that employees on social media can garner 10x the engagement of brand pages alone.

3. Twitter

Like LinkedIn, Twitter is also a great place for agents, loan officers, and advisors to share their expertise. Understandably, financial services marketers might be intimidated by the fast-paced nature of the platform and fear they don’t have enough resources to keep up. However, with the proper social media management tools, maintaining compliant engagement on Twitter is totally possible — and worth it.

One of the greatest benefits of social media marketing for financial services is the ability to provide more value to customers. Twitter makes this incredibly easy to do. Marketers can follow all relevant news media outlets and keep an eye out for any articles that might benefit their clients or prospects. For example, an explainer piece on recent changes in tax legislation may be helpful come tax season. Retweeting such helpful resources educates followers on financial topics and builds trust in the brand and its employees.

There’s no single best social media platform for marketing. Each one has a unique opportunity to reach and engage current and future customers. If you’re already on social media, it’s time to level up your social media marketing strategy by diving into Instagram, LinkedIn, Twitter, and Facebook in more depth. No matter the size of your financial institution, extending your social media strategy to encompass these platforms can help grow your audience, build trust, and maintain solid customer relationships.

Whether you love or loathe social media's infiltration into every element of our personal and professional lives, there's no denying that this powerful medium is never going away. Social networks are growing bigger and stronger by the day. Forward-thinking achievers in every industry understand this and have responded by leaning all the way into social selling.

For the unaware, social selling is using social media to sell a product or service by showcasing authenticity, strengthening relationships with clients and prospects, and building thought leadership. In social selling, advisors use their own social pages to promote content about their brand and services, but with a personal spin.

Everyone from dog groomers to financial advisors are utilizing multiple social networks to build a following and bolster their personal brands, and those who fully embrace social media's ubiquity outperform their competitors and win more business. It's as simple as that.

The key, though, is finding a way to stand out from the competition online. There's a big difference between "doing social media" and doing it well.

The difficulty with differentiation

As we all know, the internet is more than likely the first place individuals go to get advice these days — financial, familial, and absolutely everything in between. So when people go online to search for guidance on money matters, they won't find you if you aren't there, actively promoting your expertise and services.

There's no stronger business case for social media (and social selling) than that: It's where your potential customers are. Meet them there and give them what they need. If you don't, someone else will.

To set yourself apart as a financial advisor, you need to be able to sell yourself — not just your firm. Sure, many financial advisors are intermediated and you likely don't have free rein to post everything you might want to on social channels, but that shouldn't be a deal-breaker. There's still plenty to say without risking any backlash or drawing the ire of regulators.

Put your fears aside

Though some in the financial industry might feel wary or daunted by interacting directly with clients or prospects, online exchanges matter in today’s market. Brands that use a more generic social-media strategy can end up sounding too promotional, focused more on boosting the brand to a broad audience instead of forging real connections. Rather than creating original content that speaks to their particular audience, financial institutions treat these social channels as glorified billboards instead of networking opportunities for each individual advisor.

That’s too bad because there’s real power behind social selling today. When comparing the social media potential of brands vs. individuals, one study found that employees have 10 times the reach and double the engagement of the brands they speak for. The best sellers in large companies, meanwhile, were the ones who regularly used technology to foster connections with new prospects or existing clients. Building genuine relationships pays off for both advisors and brands.

So, how does someone improve their social-selling efforts? How can financial advisors use the power of their individuality to differentiate themselves from their peers? Here are five tips to help you better accomplish social selling on your personal pages:

1. Ask an expert

Even if you’re on board with tapping into the potential of authentic relationship-building through social selling, you still need the right tools and training for the job. After all, your area of expertise is in the valuable services you provide to your clients, not online marketing.

An excellent move for advisors is to seek advice from your firms’s marketing or branding team. Not only can they help you develop an effective social-selling strategy, but they can also provide you with the resources and tools you need to more effectively and efficiently create, plan, and schedule your posts. Compliance experts can also educate you on the rules that govern social media in the financial services industry. Ideally, your firm provides continuous training and tools to ensure you stay on the right side of regulations.

2. Be real

The type of posts that most people see on their social-media feeds are at least partially determined by an algorithm. These algorithms are generally designed to serve up content that users are most likely to engage with in one way or another. This can be a huge advantage, but it also means that you can’t expect to stay on people’s minds if you deliver bland, uninteresting content that isn't relevant to your audience.

That doesn’t mean you should go posting clickbait or try to shock people (there’s definitely such a thing as bad engagement). Instead, the best way to get and keep people’s attention is to be your real self. Post about what matters to you and do it in your own voice, not just copying/pasting brand posts. Post about local happenings that people in your area might care about. Speak to the challenges you hear clients ask about most. In social selling, authenticity is the fastest way to start building deeper and more lasting relationships.

3. Consistency is key

How much engagement your posts garner will often depend on when and how often you post. Not only does each channel (like Facebook or LinkedIn) tend to have different times when engagement is at its peak, but your specific audience may also have their own preferences. A little research here can go a long way.

Build a sustainable cadence and stay the course. Consistency is crucial. If you post more than once a day, make sure that each has a few hours to shine on its own. And if a post is getting a particularly high response rate, wait a while before potentially drowning it out with something new. Remember: Algorithms are looking for engagement, not frequency.

4. Mix it up

Another way to ensure better engagement (and a better response from the algorithm!) is to mix up the type of content you share. Your online presence should be a healthy medley of brand, industry, and personal and community content.

You will need to figure out what the right balance for your own audience is. Think about what they care about, the questions they ask when you work together, or specific local concerns. The bottom line in every case is to make sure you’re maintaining a variety of relevant content in your social selling strategy.

5. Give and take

Approach social media as a conversation, not a bullhorn. Social selling is about more than just getting engagement — it’s also about engaging with your audience in return. This give and take is how relationships are made and strengthened, whether they be prospects or clients you know and love.

Don’t just be reactive by responding only to comments or likes on your posts. Take time to respond to others’ posts as well, whether they’re customers or other thought leaders in the industry. This doesn’t always have to be through comments, either; a simple like can let people know you’re paying attention to what they have to say.

Social selling is a powerful tool that can help financial advisors bring in new prospects and keep old clients coming back for more advice through the power of relationship and trust building. However, in order to rise above the noise, you can’t lean on your — or your firm’s — reputation. Instead, you need to establish an authentic presence for yourself that showcases exactly what makes you the right person for the job.

Learn more by downloading our Social Selling Guidebook for Financial Institutions.

Digital transformation means that social media has become an integral part of everyday life. It has changed the way we communicate and connect with others, and it has also transformed the way financial professionals operate. Loan officers, insurance agents, and financial advisors will find that social media networks like LinkedIn have immense potential in terms of building connections, establishing thought leadership in the industry, and supporting their business.

LinkedIn has quickly become a need for financial professionals: in fact, 9 out of 10 financial advisors are currently using LinkedIn for their business, and other industries can show similar numbers, too. To leverage the full potential of LinkedIn, intermediaries should create a strong social media content and post strategy. Here’s how to get started:

Define Your Target Audience

Before creating any content or posting anything on LinkedIn, it is essential to define the right target audience. By knowing this audience, it’s easier and more effective to craft content that resonates with them, and to also tailor any message to their needs and preferences. For the financial services industry, understanding clients and prospective clients is crucial to growing connections on social media.

Develop a Content Strategy

Once the target audience is identified, the next step is to develop a content strategy that aligns with business objectives. The content strategy should focus on creating value for the audience and positioning oneself as an expert in the financial industry, be it insurance, mortgage, banking, or wealth. It’s always helpful to create a mix of content, including articles, blog posts, infographics, videos, and podcasts, depending on current events and what the target audience would prefer.

Some themes to consider using in the content strategy are:

- Industry news and trends

- Tips and advice for financial planning and investments

- Case studies and success stories

- How-to guides and tutorials

- Thought leadership pieces on industry-specific topics

Optimize The LinkedIn Profile

A LinkedIn profile is the first thing that potential connections will see. Therefore, it is essential to optimize the profile to make a good impression and establish credibility. Some tips for making a LinkedIn profile stand out are:

- Use a professional headshot

- Write a compelling headline that reflects expertise

- Craft a well-written summary that highlights skills and experience

- Add relevant keywords to the profile to make it easier for people to find in search results

- Include media such as videos, infographics, and presentations to showcase work

Engage With Connections

LinkedIn is a social media platform, and like any other social network, engagement is key. Engaging with connections demonstrates real interest in building important relationships and sharing valuable insights. Some meaningful ways to engage with connections might include:

- React to and comment on posts

- Share posts with existing network

- Send personalized messages to build rapport and establish connections

- Participate in LinkedIn groups relevant to industry

Measure and Refine Your Strategy

Finally, it is crucial to measure any LinkedIn strategy's effectiveness and refine it over time. Using social media analytics is a smart way to track an audience's engagement with posted content, such as views, likes, shares, and comments. Based on this data, it’s simple to refine an existing strategy, identify what works and what doesn't, and adjust the tactics accordingly.

In conclusion, creating a social media content and post strategy for LinkedIn can help financial professionals build connections, establish thought leadership, and support their business. By defining the right target audience, developing a content strategy, optimizing the profile, engaging with connections, and measuring and refining the approach, anyone can leverage the full potential of LinkedIn and make social media a priority.

Ready to start building your social selling game plan? Check out this Social Selling Playbook for Financial Institutions.

There are plenty of AI skeptics out there, but there’s no doubt about it: these tools are here to stay! Marketers that don’t embrace the features of AI and how they can make your content work smarter, not harder, will fall behind those that don’t. There are many ways that AI can boost an institution’s social media strategy, and combined with other social selling tools, it can be an invaluable asset for your team.

Running a social selling program is no easy feat, and one of the main challenges to overcome is giving users guidance and content to create their own engaging social media posts. That’s where AI comes in! It’s not about replacing people or taking away their voices: it’s about giving them assistance to do more with less. AI like Denim Social’s Social Sidekick take off the pressure of crafting the perfect message. That way, loan officers, insurance agents, and financial advisors can build a presence on social media without having to spend too much time on it (and so they can focus on their business!).

If you’re hesitant to adopt AI in your social media strategy, consider these three ways that it can make your content stronger than ever.

- AI can help you start a post. The proverbial writers’ block: even the most seasoned marketers can experience it, and for those that aren’t trained in social media writing, it can be a serious issue when trying to convey a message. Oftentimes, social sellers know what they want to say, but aren’t sure how to say it or how to begin. AI should never replace authentic, human content, but it can give users something a launch pad for what they need to say. Having that initial push can open the door to future content success for inexperienced users, especially.

- AI can help you build a content library. For many institutions, a major key to social selling success is providing team members with guidance on what to post. If you are the administrator for your institution’s program, that’s a lot of pressure, time, and effort spent building up content to share with users. With AI, it’s much easier to increase the quantity of content without increasing any individual’s overall output. Having a more robust library means more social media posts going out and more access to valuable resources for brands and their users.

- AI can fine tune your messaging. Sometimes a post just isn’t quite right. Especially when complex subjects around financial services are up for discussion, getting the right tone and wording is hard to do. You want to be both educational and entertaining, so it’s always about striking the right balance with the message. It’s easy to be either too vague or too wordy. With AI, you can easily reword and regenerate a message to be more clear and concise if needed. Even better, you can be assured that your post is grammatically correct and formatted as needed. It’s perfect for social sellers that are just starting out or worried about posting the right way.

Don’t let uncertainty about AI keep you from taking advantage of such a powerful and helpful tool. It can work wonders for institutions that are trying to drive user adoption, make the most of limited resources, or simply trying to boost their social media presence. There are many functions AI can serve, but most importantly, it can increase your social selling efficiency. Thanks to the Denim Social platform’s integrated AI compliance workflows, you can also control what’s being posted across all users and networks, too.

Sign up for a demo today to learn more about how it works and what it can do for your institution.

What Is Social Selling?

Whether you’re in banking, wealth management, insurance or mortgage, relationships are the bedrock of your business.

Considering clients in these industries are handing over the keys to their personal kingdoms, it’s no surprise that trust and connection matter. That’s why successful sales strategies for these industries are focused on building long-term, trusted relationships. While this has traditionally been done in person for financial services, the digital landscape offers endless possibilities for relationship building. By now marketers and business leaders are familiar with social media and see the opportunity to build their brand, but most have only scratched the surface. To truly unleash the potential of social, financial institutions need to use social media as a sales tool.

It’s called social selling and it works.

Social selling is just what it sounds like: using social media to sell a product or service. It’s leveraging social to build personal relationships, showcase thought leadership, engage with prospects, interact with existing customers, and ultimately build trust and rapport that will eventually lead to sales.

Social selling is the perfect crossroads of marketing and sales. It enables intermediaries – like loan officers, financial advisors and insurance agents – to add value to the customer journey where there wouldn’t otherwise be an opportunity. Savvy marketing and sales teams unlock the power of relationships with social selling, enabling intermediaries to compliantly communicate, share and sell on the social channels of their choice.

Consider this: employees have 10x the reach and drive double the engagement compared to brand pages on social media. But it’s about more than likes and comments, social selling can transform social media into a revenue driver for your institution. Sales reps who regularly share content are 57% more likely to generate leads. The numbers check out, but social selling is also about building the intangible relationships that are the lifeblood of the industry.

The Intermediary is Here to Stay! Social Selling is a non-negotiable to drive a modern marketing strategy.

Products are increasingly digitized and direct-to-consumer business is on the rise, but that doesn’t mean the role of the intermediary is going away. It’s just changing. The way agents, loan officers and advisors interact with digital products will look different from the past, but the role of the advisor will always be needed. Human connection will remain a meaningful part of financial transactions. As expectations change, marketing and sales teams need to meet consumers on the channel of their choice. Social media isn’t going anywhere. It’s where consumers are interacting with each other, looking for advice, and looking for thought leadership on important life topics. This means intermediaries and producers have to be there.

My brand is on social media, so we’re social selling, right?

Not quite. If your brand is active on social media, you’re off to a great start, but you’re leaving opportunity on the table if you’re not empowering agents, loan officers, advisors and more to share on social. If you only have brand pages, you’re not social selling yet.

Watch Here: Beyond the Brand | Social Selling Best Practices

Forward-thinking marketers understand the power of social media at all stages of their marketing funnel. From awareness and consideration to loyalty and even advocacy, social and digital channels can and do inform purchase decisions. Financial institutions are catching on — more than 90% of the 50 largest banks are currently on Facebook, and 88% have active Twitter accounts — but being on social media doesn’t equate to a strong social media strategy. Today’s digital market requires an integrated strategy that meets target audiences throughout the buyer’s journey. This means investing in paid social campaigns alongside organic and driving deeper relationships with customers through social selling.

Sounds easy, right? While marketers may understand the strategies and costs associated with modern social success, senior decision makers may still need educating and persuading. That’s why it’s essential to be able to effectively communicate the benefits of integrated social media strategies. In addition to intangible benefits like building trust and humanizing your brand, both organic and paid social selling strategies offer metrics that enable marketers to prove value.

The Intermediary is Here to Stay: Products are increasingly digitized and direct-to-consumer business is on the rise, but that doesn’t mean the role of the intermediary is going away. It’s just changing. The way agents, loan officers and advisors interact with digital products will look different from the past, but the role of the advisor will always be needed. Human connection will remain a meaningful part of financial transactions.

As expectations change, marketing and sales teams need to meet consumers on the channel of their choice. Social media isn’t going anywhere. It’s where consumers are interacting with each other, looking for advice, and looking for thought leadership on important life topics. This means intermediaries and producers have to be there.

Building A Social Selling Program

Being responsible for your team’s social selling strategy can be daunting, especially if you don’t have a plan or support. We see it firsthand at Denim Social – without a meaningful strategy, users may not be eager (or downright resistant) to jump on a new platform. So, how are others getting their teams onboard? We talked to a few Denim Social customers to learn how they’re making it happen and we saw four keys to adoption success.

Activate a hybrid distribution approach.

We find that teams that utilize social selling have the most empowered associates because they are able to create personalized, engaging content. However, we have also found that a hybrid distribution approach can be a great stepping stone to social selling. This usually includes the marketing team posting brand content on behalf of associates, and associates scheduling out pre-approved industry content from a content library, plus sprinkling in their own personal content. And rest assured, that personal content still goes through approval workflows.

Build a robust content library.

If you’re going to ask associates to post content, you’ve got to make it easy and compliant. Our platform offers content libraries filled with pre-approved posts. We see that when associates have lots of content to choose from, they post more frequently.

“We have implemented several resources and training opportunities to encourage users to stay engaged. We update libraries on a weekly basis and send a weekly content digest via email to remind our users to get into the system and schedule their posts, said Amy Leonard, officer digital marketing specialist at Johnson Financial Group.

Communicate the value of social media consistently.

Your teams need to be able to answer the age-old question, “what’s in it for me?” Your teams are busy and that means you need to help them see why spending their valuable time on social media is worth it.

“Whenever you bring on a new platform, user adoption can be a challenge. Once users embrace Denim Social, they see that it actually saves them time,” said Leonard.

Seth Reeks from Evolve Bank and Trust finds that communicating the benefits of social media AND Denim Social combined are the most impactful. He uses real information from top performers to show their peers why social media can help drive relationships and business. He provides them with brand and industry focused content on an ongoing basis. Then he shows them how they can schedule out their content efficiently using Denim Social.

“I tell them if they put in just a little work at the beginning of the month, they’ll see big results,” said Reeks.

Train and Train Again

Baking social media and Denim Social training into the onboarding process is a great way to introduce new and motivated associates to a fresh way to drive their business. It is also important to keep social media top of mind for ALL associates. An ongoing training program outlining compliance/social policy, the value of social media and Denim Social is a must, whether it be monthly or quarterly. Marketing is not often top of mind for salespeople, so it is important to continuously educate them on how to get involved and optimize their strategies.

Allison Dickinson, social media specialist at AnnieMac Home Mortgage oversees the creation of their hugely successful mortgage loan officer training program, which includes a monthly new hire social media and compliance training course and Denim Social overview, a monthly Denim Social refresher training, a Quarterly Strategy Training, and ongoing 1:1 assistance for users.

“We have monthly Denim Refresh trainings to keep our users updated and knowledgeable about the platform. One thing we like to do is host one-on-one trainings to make sure they understand the workflow and that Denim is easy for them to use,” said Dickinson.

This training program is a well oiled machine, and keeps their social program growing by educating and informing users consistently.

If you’re struggling with adoption, these strategies can help. And of course, persistence pays off.

“Don’t give up! In the beginning, we had no users, no one managing their social media. Now we have over 100 users handling their own social media accounts,” said Reeks. “If we had quit back in the beginning when it was tough to get buy-in, we wouldn’t have the program that we have now.”

Social media is only as valuable as its users and that makes adoption key. If you’re struggling to motivate your team to hop on the social media bandwagon the right tools and support can make all the difference.

Watch Here: Driving User Engagement on Social Media

So you’re ready to launch a social selling program, but where do you start?

Developing a social selling strategy and launching a program can be daunting. As you know, marketing and sales teams are already juggling full plates. Adding social to the mix is a culture shift, and supporting hundreds or thousands of producers in weaving social into their everyday processes isn’t a small feat. Remember that social selling is more than marketing: It’s using social media as a digital relationship-building and sales tool. This mindset shift can take some time, and launching your strategy and program won’t happen overnight.

This is one of our favorites: LinkedIn’s 2022 State of Sales Report found the most successful sellers at large companies — those reaching more than 150% of quota — routinely use technology to build human connections with buyers.

Align with Your Team on the Definition of Social Selling

As a marketing pro, you know what social selling is by now, but what about your team? This step may sound obvious, but you need to work to define social selling in your organization and differentiate from brand social media. Intermediaries may have less experience with social selling. Take the time to talk about what social selling can do and educate your teams on using social media as a sales tool. This time spent learning a new marketing tactic is very much worth your loan officers’, advisors’ and agents’ time, too. Prove it to them by sharing meaningful stats on the benefits of social selling.

Educate Your Sales Team

Remember that social selling isn’t just marketing’s responsibility. It’s an effort that should be supported by both marketing and sales. If you’re in a marketing role looking to launch social selling for your advisors, loan officers and/or agents, take the time to educate your sales partners on social selling. Craft your elevator pitch on how social helps intermediaries meet customers where they are in the digital landscape and how enabling them on social helps amplify your brand messaging. Keep in mind that social media in a heavily regulated industry can feel risky, and adding it to the mix of sales tactics that have “always been done a certain way” can feel like a huge change. Patience is key! Own the narrative around social selling, build your group of internal champions to help with this culture shift, and invest time in change management and your communication plan.

Find Your Social Selling Technology

Once you’ve got your internal teams aligned on launching social selling for your producers, it’s important to find a tech solution to make it all easier! Seek a solution that creates efficiencies for the administrators of your program and your users. For instance, does your platform account for compliance coverage? Does your vendor understand the nuances of your industry? As you’re evaluating potential platforms, make sure to consider both the administrative and end-user experience, as well as both organic and paid capabilities. A holistic social selling platform will include all these things.

Identify Social Maturity

So you’re changing the narrative, gaining buy-in, and you’ve got the right tools to help you — what’s next? It’s time to dig into your user group to identify social maturity. You don’t have to do it all at once — a phased approach with folks of different social maturity levels will make this easier to learn and scale from. Start by simply searching for your intermediaries on social media. How easy is it to find them? Are their pages updated and on brand? Is their “about” info robust and accurate? Have their profile photos been updated in the last decade? If you are answering “yes” to a lot of these, you already have a great start. Those are your people. But if you aren’t, that’s OK — you’ll just need to start with some generalized social education and profile optimization to get your group started. Taking the time to deliver this education is critical in making social selling stick.

Train and Test Your User Group

Once you’ve identified agents, advisors or loan officers who are either already active on social or ready to be active, start communicating. Let your whole organization know that you’re launching a social selling program. The more folks who know, the more they can support your work. Then, communicate with your first user group; let them know what to expect throughout the launch, including your level of support and upcoming training to get them started. And finally... train! Depending on the level of social maturity of your launch group, this might mean starting with the basics of each social platform, as well as the basics of organic and paid social. If your users are super ready, it could mean jumping right into your social selling tech solution.

Measure Success and Optimize Over Time

Once you have momentum, fuel that success with regular content. It takes time: Start simply by creating versions of your brand content for individuals and add this content to your content planning processes (for instance, you might craft language your agents can use to share branded social posts). One of the perks of Denim Social? We curate your library with our content integration. Finally, measure your success and share it with your internal champions, teams, and leadership. Your measurement might just consist of basic content usage and engagement at first, but it will ultimately grow to measuring return on ad spend and leads generated. Take the time to celebrate small wins and educate your internal partners on the growth of your social selling program. Check in with your social sellers to make sure they’re understanding the value and celebrating with you.

Download: Social Selling Made Easy

Want to keep learning and training with your team?

Social Selling Best Practices

If you are posting the same content on every social media network, you might be missing out on key engagement opportunities for your social selling strategy. What gets the most attention and engagement on Facebook, Instagram, Twitter, or LinkedIn isn’t universal, and financial marketers would be wise to seek a more nuanced strategy than just casting a wide net and hoping for the best. While there are general best practices to posting on social, making just a few distinctions to how you approach each of your networks can help you beat the dreaded social media algorithms and build credibility and expertise at the brand and individual producer levels. Let’s take a look at each network and how banks, wealth management firms, insurance agencies, and mortgage lenders can customize their strategies to the unique needs of each network to achieve growth and success.

Facebook: This is what you should know about our financial institution.

Despite the emergence of new networks and the inevitable departure of Gen Z and Millennials, Facebook is still the most popular social media network, and it’s a non-negotiable for any business. For community banks and other smaller financial businesses, it is the perfect medium to connect with local communities. This network will be one of the first places many customers look for a business, so having updated and branded profile information is essential. It’s ideal for sharing important dates or events, announcements, or anything customers need to be in the know about. Utilize brand pages for general information, and allow your agents, advisors, or employees to curate more personalized content on their individual business pages.

How To Succeed:

- Share a wide variety of content geared towards informing and connecting with audiences

- Post content related to the local community and partnerships with other business or organizations

- Take advantage of user-generated content to build and maintain relationships with customers at the brand and producer levels

Download: Best Practices for Building Your Facebook Page

Twitter: Talking about our #financialinstitution.

Sometimes Twitter seems like a mystery with its unique format, hashtag content, and 280-character limit. Like any other network, customers and prospects will consult a company’s account to find information they need to know; but more importantly, Twitter is a network people go to in order to hear news and opinions - and share their own. It is primarily a resource for sharing thought leadership and staying informed about industry updates. To be set up for success, brands and producers should follow relevant accounts like competitors, local businesses, and industry leaders. Hashtags are a useful way to learn about the broader conversations happening- plus, they provide insight into the hashtags marketers should be incorporating as well. Like any other network, brands engaging in social selling will enjoy the benefit of more engagement and awareness opportunities.

How To Succeed:

- Prioritize engaging in existing conversations, rather than creating original content

- Retweet relevant information for your customers and your brand, and utilize the mention function to increase visibility

- Follow and use hashtags related to your industry to stay connected to current events and other thought leaders

Download: Best Practices for Building Your Twitter Profile

LinkedIn: This is what our financial institution wants you to know, and why.

Branded as the professional social network, LinkedIn is perhaps the most important place for financial services brands and employees to be when it comes to social selling. This is a great way for brands to grow their reach by tapping into the power of user connections through sharing thought leadership and need-to-know information regarding their industry. Plus, authenticity is increasingly important on LinkedIn, with customers preferring to interact with brands that seem more relatable. Marketers and individual producers can use LinkedIn to share those values and insights into company culture that make people feel connected: photos, videos, and important awards or achievements can help boost engagement and brand awareness. With the power of a brand page combined with employee advocacy through social selling, LinkedIn should be a main focal point for any financial institution.

How To Succeed:

- Share images of community and in-person interactions and events with context on what it means to your business

- Follow local businesses from your actual business page (such as: local library, schools, industry competitors, local figures) and engage with their posts from your business page

- Share high-performing posts from industry thought leaders and other local businesses; this boosts their engagement and gets visibility for both of you

Download: Best Practices for Building Your LinkedIn Profile

Instagram: Here’s a photo or video of what our financial institution values.

As a highly popular and visually-appealing social media network, Instagram is ideal for demonstrating a more human side to any financial brand, which is especially important for connecting with younger customers. This network is meant to be fun and entertaining for followers, while also staying on brand for financial companies and still informative. Of all the networks, Instagram is going to be the easiest way to reach younger audiences and get creative with content. For brands engaging in social selling, it’s a fun way to give producers a chance to show their personality and connect with customers on a more casual level. Instagram is also very dynamic and visual: the Reels and Stories functions provide alternative ways to share and engage quickly with video, which provides more opportunities to get in front of audiences within the platform than image posts alone.

How To Succeed:

- Post images from community or in-person interactions; share important posts to brand and producer Stories, then save to Highlights

- Use emojis in copy and keep text light and fun; it’s all about the visuals on this network

- Follow other businesses/industry thought leaders; engage with their content and share posts to your own stories

Download: Best Practices for Building Your Instagram Profile

While every network has its own charms and best practices, there are a few overall things to keep in mind when launching a social selling program: stay authentic and non-salesy; keep compliance matters in mind; know how to maintain a balanced and informed feed; and finally, don’t forget that paid advertising can boost organic efforts on any network. Knowing what to post on each social media network can be overwhelming, but understanding the best way to approach social selling at the brand and individual levels on Facebook, Instagram, Twitter, and LinkedIn will translate to more engagement, better brand awareness, and increased trust from industry leaders and customers. With a little fine-tuning and support for your team, you can see the difference a network-based content approach can make for your financial institution.

Check Out These Social Media Network Best Practices for Social Selling:

Let’s talk about social media compliance for financial institutions.

In today’s digital landscape, marketers know that social media is a key element to any successful strategy. Social selling is a smart approach to empower financial advisors, loan officers and associates in social media, but it comes with risks. After all, just one rogue post could land your financial institution in regulatory hot water. Compliance is complicated, but don’t let it stop your employees from making the most of social media. Think your team is ready to start social selling? Ask yourself these five questions:

Do I know who has social media access and control?

Your social strategy won’t be compliant unless it’s properly governed, so start by clearly documenting who has access to and control over what social media channels. According to the FFIEC, your social media policy needs to clearly outline individual roles and responsibilities on social. When roles are clearly defined, you’ll eliminate authorization confusion and avoid regulatory trip wires

Is my social media policy well-documented?

If you don’t already have a social media policy in place, then it’s time to put one together. If you already have one, check that it is up-to-date. Ensure the policy is easy for all employees to digest, understand and implement.

Am I tuned-in to what’s happening on my social channels?

You should be monitoring all activity across your brand’s and employees’ social media channel to ensure posts and engagement is compliant.

Am I prepared for an audit?

Surprise! You’re being audited. Be sure you’re ready with a social media archive that captures all postings and engagement activity.

Do I have a clear picture of my social media risks?

You could be fined for a mistake that slipped through the cracks if you don’t have fail-safes, like approvals and compliance checks, in your workflows. Start with a social media risk assessment, and if you already have one, consider re-reviewing it regularly.

Trend Report: A Marketer’s Guide to Social Selling

As financial marketers look to the coming year, most are wondering, “what’s next?” While no one can say for sure, our team of experts here at Denim Social are keeping a pulse on what’s new in digital marketing for financial institutions. Surely every marketer has found frustration in the often slower-than-average pace of digital adoption and change in the financial industry, but there can be benefits. Namely, financial marketers can look to more forward industries (like consumer brands and tech), to see what’s catching on and evolving. Even if you’re not quite ready to dive-in, as new trends emerge, financial marketers can begin to lay the groundwork with leaders for the future. Whether you’re in banking, mortgage, insurance or wealth management, we see a few key trends that every financial institution should begin preparing for.

But why change what’s working? If your institution hasn’t already come around to digital first marketing, let us put this gently – it’s time. In practice, this looks like moving marketing dollars from traditional media to social media centric digital strategies. Consumers in every age group are shifting to digital and it becomes more pronounced the younger the consumer. Younger generations are digital natives and their use of technology is rapidly increasing. In fact, about half of teens say they use the internet almost constantly, up from only about a quarter of teenagers who said the same less than 10 years ago.

We get it, teens aren’t big revenue drivers for your institution… yet. Believe it or not, younger generation buyers now dominate the housing market, with Millennials representing 43% of home buyers. Housing is only the tip of the iceberg with younger audiences too. A massive generational transfer is underway as Baby Boomers age. Experts predict that $84 trillion will change hands in the next 25 years. All of this is to say, financial marketers need to be where their consumers are. Today, that means social media. Digital marketing and social media show no signs of slowing down, so financial institutions need to invest accordingly.

Growth of Short-Form Video Content for Financial Services

Growth in short-form video is both changing what consumers watch and how they watch it. Even on other more traditional social media networks, attention spans are getting shorter. For example, short-form videos were just 21% of YouTube views in Q2 2021, but jumped to a whopping 57% of views in Q2 2022. Social media users are favoring videos in the 30 second to 1-minute range.

The Rise of Financial Advice Influencers

Whether institutions like it or not, people are getting financial advice on social media. And it’s a trend that’s unlikely to change – Generation Z are almost five times more likely to get financial advice from social media platforms than people aged 41 or over. While this may feel like a challenge for financial marketers, at Denim Social, we see it as a massive opportunity.

Increase in Personal Content and More Authenticity on Professional Channels

As more and more institutions adopt social selling strategies that put their people front and center, we’re seeing an increase in personal content. User-generated content is at the heart of a good social selling strategy because it is authentic.

Enhanced Marketing Automation Connections

As institutions build out bigger social selling programs that include both paid and organic strategies, scale is always a challenge. Smart marketers are looking to increase marketing automations to help them effectively and efficiently manage digital marketing strategies. In fact, 63% of marketers plan to increase their marketing automation budgets.

Social Media as Search Engine

Social media has long been viewed as an excellent brand-building tool, but today, financial institutions need to consider the value of social profiles for search discoverability. Increasingly audiences – especially younger ones – are using social media as a search engine. Recent Google research shows that nearly 40% of Gen Z prefers using TikTok and Instagram for search over Google.

The future of social media for financial institutions is bright and marketers who continue to advocate for increased social resources will reap the rewards. Whether you’re launching a social selling program or building your marketing automations, thinking long-term will help your team build toward a more connected and successful future. Remember this: You don’t have to be ready to dive into the next big thing right now, but it’s important to stay current with the social media trends of today so that you don’t get left behind tomorrow.

Content Strategy

Watch: Marketing Mix for an Informed & Healthy Social Media Feed

Organic social media should still have a place in your strategy, especially in a social selling program. Cultivating organic posts from your associates' accounts is a great way to add context, richness, and humanity to your brand. For current customers, organic social media posts can be a way to demonstrate the heart and culture of your company as you provide “behind the scenes” and in-office content that speaks to the personalities and values of your employees and institution.

For prospective customers, organic social can serve as a "verifier." A strong social media presence signals to prospects that your company and employees are legitimate and lends more insight into your value proposition.