What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

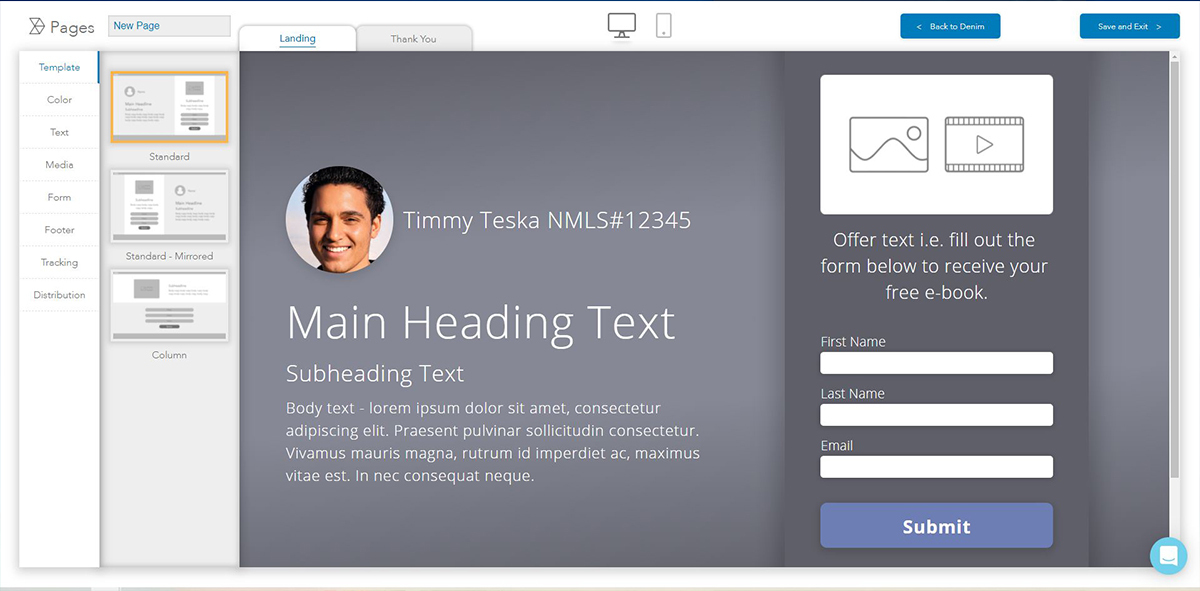

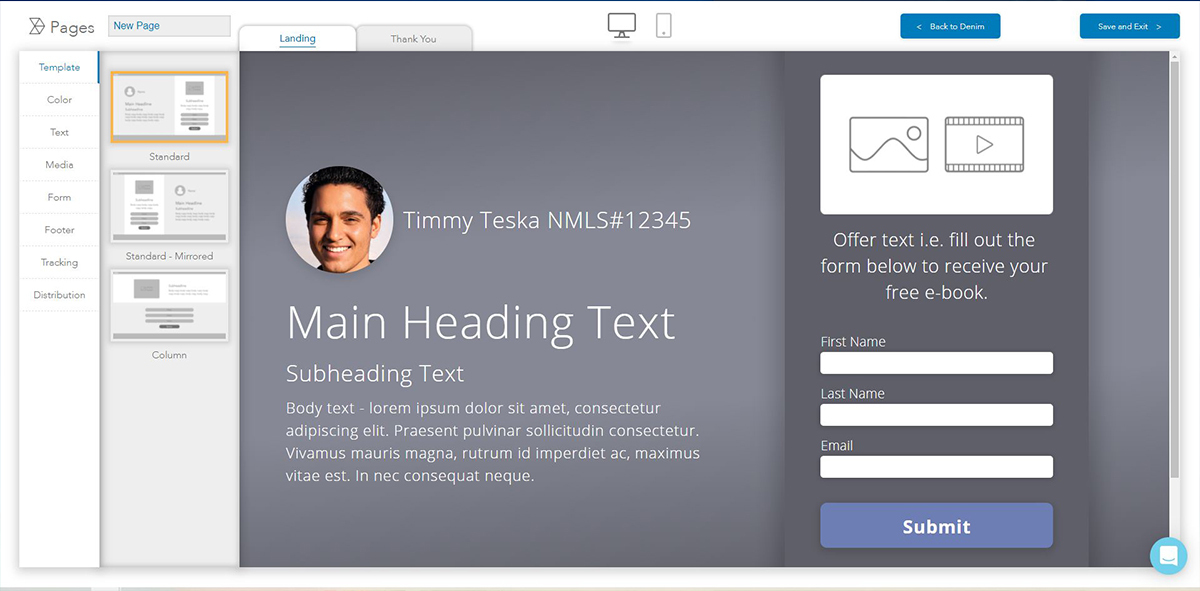

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale

Omnichannel marketing addresses the customer’s individual needs during each step of the journey. But undertaking personalization for every customer is a Herculean task, so it needs to be automated and streamlined. This can be more basic, such as setting up newsletters to nurture leads that are automatically sent out at regular intervals, but it doesn’t have to be. The right tools can create connections between your digital marketing strategies and CRM records and automatically keep each other updated.

You also need to consider regulatory compliance with social media posts. A proper social media manager should screen posts for you, flagging any that may contain non-compliant content. Social selling relies on empowering intermediaries to connect with customers directly, so having a good management software in place to oversee all this activity is essential. Technology allows for omnichannel marketing in banks of all sizes. The more tasks you can automate, the more time you allow for higher-level responsibilities.

Omnichannel marketing is a highly effective strategy, but only if it’s implemented wisely. By using technology to their advantage, banks can target a multitude of audiences, allowing for greater reach and more conversions. Effectively utilizing paid ads and understanding how omnichannel allows for more personalized messaging will keep your bank ahead of competitors.

This article was originally published in ABA Bank Marketing.

What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale

Omnichannel marketing addresses the customer’s individual needs during each step of the journey. But undertaking personalization for every customer is a Herculean task, so it needs to be automated and streamlined. This can be more basic, such as setting up newsletters to nurture leads that are automatically sent out at regular intervals, but it doesn’t have to be. The right tools can create connections between your digital marketing strategies and CRM records and automatically keep each other updated.

You also need to consider regulatory compliance with social media posts. A proper social media manager should screen posts for you, flagging any that may contain non-compliant content. Social selling relies on empowering intermediaries to connect with customers directly, so having a good management software in place to oversee all this activity is essential. Technology allows for omnichannel marketing in banks of all sizes. The more tasks you can automate, the more time you allow for higher-level responsibilities.

Omnichannel marketing is a highly effective strategy, but only if it’s implemented wisely. By using technology to their advantage, banks can target a multitude of audiences, allowing for greater reach and more conversions. Effectively utilizing paid ads and understanding how omnichannel allows for more personalized messaging will keep your bank ahead of competitors.

This article was originally published in ABA Bank Marketing.

Retail banks in the U.S. are facing a major customer attrition challenges. According to a recent Bain report, customers make as many as 55 percent of financial-related purchases from their primary bank’s competitors. While primary banks may be able to retain customers’ savings and checking accounts, the report suggests that they’re likely losing out on lucrative sales when it comes to loans, credit cards and investments.

Considering that almost one-third of those who defected from their primary bank did so in response to a direct offer from a competitor, wise marketers will up their customer engagement and outreach efforts to retain more customers. Affordability of products is the top reason for customer defection, which marketers may not have much say in, but it isn’t the only contributing factor. Digitization has also been a major catalyst. Namely, the strong digital products and experiences that some banks offer—and others do not.

Bank marketers who can jump onboard the digitization train to meet customers where they are with engaging, valuable messaging will be much more likely to keep customers coming back again and again for each of their financial needs. The following strategies can help:

1. Put the human element front and center

Traditional banks have an innate advantage over digital direct banks: The human touch. Leveraging this benefit, especially when it comes to increasingly digital customer interactions, can lead to measurable improvements in customer retention.

One way to ensure the human touch remains part of every customer touchpoint is to focus on personalization. A February Insurance Thought Leadership piece revealed that 72 percent of people ignore marketing that’s not highly personalized. So targeting relevant content to the right recipients is essential, especially when digitization can easily strip the human element out of an interaction. Personalizing messaging and services to be relevant and valuable to the specific needs of each customer can bring the human element into focus even in a digital world.

One way to create more relevant, personalized outreach is to practice social selling, or leveraging a bank’s employees on social media. People can relate more to other people than they can to big brand names. When your employees are the ones getting in front of customers virtually, it humanizes the digital customer experience and sets the stage for trusting and loyal relationships to come. What’s more, employees also tend to have further reach and engagement on brand-related social posts than brand pages alone, so they can expand the impact of your messaging exponentially.

2. Create digital pathways to human interactions

When considering how to anchor all digital marketing for financial services around the human element, keep in mind that every pathway should connect prospects and customers directly to a human.

For example, a social media post from an employee could include a link to a landing page on your website where visitors can learn more valuable information on the topic of the post. On that landing page, you can include valuable content, such as a guidebook, behind an information request form. When users submit their names and email addresses, they will receive the content and your sales team members can reach out to them directly with a human-centric, personalized outreach approach.

When prospects and customers know they’re just an email or phone call away from a real person at your organization, they’re likely to turn to you instead of an impersonal digital direct bank for their next financial need.

3. Focus on customer retention just as much as acquisition

Bringing in new prospects gets a lot of attention from financial services marketers, sometimes at the expense of retaining current ones. But focusing on customer retention and continuously improving the digital customer experience will help secure more revenue when it comes to additional services such as loans and credit cards.

Listen to the needs of customers and keep refining your personalization tactics to meet their needs. Every time you get in front of a current customer with relevant, valuable messaging or content, you help build trust in that relationship and increase the chances of that customer coming to you for whatever service they need next.

It’s true that people will always be drawn to brands that offer more affordable products and services. But money isn’t the only reason people look outside of their primary bank to fulfill their financial needs. Banks that differentiate by focusing on digitization alongside the human element will find that it’s easier to keep current customers from looking for greener pastures.

This was originally published on ABA Bank Marketing.

If you didn’t want to believe it before, digital banking is here to stay. While most were on the path toward digital, COVID vastly accelerated digital adoption. That behavior is unlikely to change: 84 percent of banking customers polled said they plan to maintain the same level of digital banking services post-pandemic. This is both a challenge and an opportunity for traditional banks.

The good news is that the key differentiating factor for traditional banks remains the same: human relationships with customers.

The challenge is that maintaining strong relationships in a digital environment can be difficult for traditional banks. And without strong anchoring relationships, banks miss out on valuable cross-selling opportunities and lose customers to competitors that offer better digital services. Customer defection can be costly, as it’s five to 25 times more expensive to acquire than retain customers—but increasing customer retention rates by a mere 5 percent can boost profits by 25 to 95 percent.

Banks that turn their focus toward strengthening digital customer experience can solidify relationships for the long term, secure more business with new and existing customers, and thrive well into the future.

HOW TO CREATE AN EXCEPTIONAL DIGITAL CUSTOMER EXPERIENCE

Delivering high-quality digital experiences is two-fold challenge for banks. First, traditional banks tend to struggle to design meaningful and emotional experiences in digital ways. Second, they struggle to deliver those experiences impactfully due to internal and external digital transformation hurdles.

With these two challenges in mind, bank marketers can lead their organizations to success by first focusing on their teams’ willingness to evolve and openness to the larger concepts of digital transformation. Without widespread buy-in, even a million of the fanciest bells and whistles on the market won’t help a bank evolve to meet and exceed consumers’ digital expectations.

Marketers must ensure an overall understanding of these four digital transformation initiatives and how they can help improve digital customer experiences and strengthen human relationships:

1. Continual tool improvement and refinement. Most financial institutions likely accelerated the pace of their digital transformations in recent years and they need to keep up the momentum. In fact, the primary goal behind digital transformation for 79 percent of respondents in one survey was to improve customer experience. You can’t improve experiences without continuous transformation efforts.

Gather data to show how customers are using your digital tools and continually evaluate how to improve your tools to create better and better experiences. Seeking strong and strategic partnerships with fintech vendors is an excellent way to stay on top of the latest innovations in technology and continue providing the best digital services.

2. Optimal onboarding. Your team and fintech partners might put a lot of time, money, and effort into building new and impressive digital widgets—but if your customers don’t know how to use them, they won’t bring any value. That’s why part of any bank’s digital transformation strategy should involve onboarding customers to ensure the adoption and use of new digital services.If new account openers don’t engage within the first month of opening an account, they likely never will. Encourage frequent and continued engagement by clearly demonstrating the value customers can find in your digital services and tools. Provide convenient and accessible customer support to keep the value stream flowing without interruption.

3. Transferring relationships to digital. Preserving human connections in the virtual world can be a challenge for banks accustomed to old ways, but with the right approach, digitization can actually help banks build and maintain stronger relationships. That’s why 72 percent of business leaders who responded to Harvard Business Review Analytics Services researchers said they expected the digital shift to create closer relationships with customers.

Take social media as one example. With an active social media strategy, loan officers can keep up with past customers and even get new prospects’ attention. And with the right social media management tools, marketers can help loan officers pull off social selling campaigns at scale. Ensure that customers also have a direct line to access employees who can facilitate customer service so that they always have a resource to answer questions and guide them along the digital journey without a hitch.

4. Constant value with content and data. The more value a financial institution can offer, the less likely customer defection will be. Provide useful information to customers through frequent social media content, blog posts, landing pages and more. Use targeting strategies such as paid social media advertising and create personalized content based on data. The more relevant the information is to your customers’ specific needs, the more valuable it will be. Personalize landing pages and gate information behind contact submission forms. When visitors exchange their contact information for the content they need, you can reach out directly to primed leads to continue the conversation with human-to-human touchpoints.

No matter the state of digital transformation, strong customer sentiment around digital banking is unlikely to wane. In fact, consumers are likely to expect better and better digital experiences from financial institutions as technology becomes an even bigger part of everyday life. Traditional banks that focus on creating exceptional digital customer experience based on human connection will thrive.

This article was originally published on ABA Bank Marketing.

Denim Social is proud to be featured in the American Banker Association’s 2023 report on The State of Social Media in Banking.

In the report, the American Bankers Association asked over 330 banks what they are doing with social media, where they see challenges and opportunities and what the future is likely to bring.

The report incorporates the survey findings with insight and best practices from other banks from across the U.S. and provides a list of 10 top takeaways to consider.

“Social media is the heart of social selling,” said Doug Wilber, CEO of Denim Social, which offers the only ABA-endorsed social media management platform for financial institutions. Social selling is the process of building relationships and brand awareness through selected social media platforms, with the aim of boosting not just awareness, but the bank’s sales results. It’s a way of connecting directly with prospects, and can be a powerful complement to tried-and-true methods such as cold calling and email marketing.”

Learn more about social media opportunities for banks by downloading the report here.

ST. LOUIS, August 30, 2023 – Capacity, an AI-powered support automation platform, today announced the acquisitions of Denim Social and LumenVox. Capacity’s support automation platform empowers teams to do their best work and deliver valuable customer experiences across channels. With the addition of Denim Social and LumenVox’s products, the platform is charting a course to provide solutions that define the future of work and omnichannel customer engagement for its 1,900+ customers across numerous industries.

Capacity’s acquisitions of Denim Social and LumenVox are fueling its transformation from a self-service, single channel tool to an omnichannel support and engagement automation platform. Whether providing customer and employee support, assisting agents or reaching out to customers, the Capacity platform now offers a complete solution across web, voice, SMS, email and social media.

“Customers need support everywhere. Our expanded platform will free up team members to do their best work while also building more meaningful relationships with their customers,” said David Karandish, CEO, Capacity. “Denim Social’s platform will empower brands to more effectively communicate with customers on their social channel of choice and LumenVox’s tools are key in our expansion into voice automation.”

Denim Social, based in St. Louis, is a software provider that elevates the way professionals in the banking, insurance, mortgage and wealth management industries connect and sell on social media. With Denim Social integrated into the platform, Capacity users will be able to launch proactive social media campaigns to reach customers and deepen relationships.

“Social media is a must-have tool for today’s modern seller. Combining Capacity’s AI-powered automations with Denim Social’s campaign tools will enable users across industries to more effectively stay engaged on social media and focus their time on delivering authentic interactions,” said Doug Wilber, CEO, Denim Social. Wilber has assumed the role of Chief Strategy Officer at Capacity, following the acquisition.

LumenVox is a leading global speech and voice technology provider based out of San Diego. LumenVox works with customers to build secure self-service and customer-agent interactions. Its tools will enable Capacity users to transform customer engagement with AI-driven speech recognition and voice authentication technology.

“The right voice technology can save teams countless support hours. Marrying LumenVox’s technology with the Capacity platform ensures voice is a seamless part of the omnichannel experience,” said Nigel Quinnin, CEO, LumenVox. Quinnin will lead Capacity’s voice initiatives.

The acquisitions of Denim Social and LumenVox significantly expand the capabilities and scale of the Capacity platform. Today, Capacity estimates that every month its platform will:

- Analyze 3,000,000,000 calls

- Send 10,000,000 SMS messages

- Deliver 500,000 social posts

- Execute 386,000 workflows and automations

- Deflect 140,000 tickets and emails

“With these two great additions to the Capacity platform, we’re proudly offering customers an all-in-one solution for support and customer experience,” said Karandish.

Capacity’s acquisitions of Denim Social and LumenVox closely follows a deal with Textel, an enterprise SMS provider, earlier this year. Capacity will maintain its headquarters in St. Louis. With the acquisitions, its headcount is now more than 100 employees. The terms of the transactions are confidential.

For more information on how Capacity helps teams do their best work, please visit capacity.com/omnichannel.

About Capacity

Founded in 2017, Capacity is a support automation platform that uses AI to promote self-service, providing immediate Tier 0 and Tier 1 support for customers and internal teams. Capacity answers over 90% of FAQs and escalates more pressing, nuanced issues to the right person. Capacity works across web, voice, SMS, email and social media to help teams do their best work. For more information, visit Capacity.com.

About Denim Social

Denim Social is a Software As A Service (SaaS) provider that powers social selling programs. The Denim Social platform helps brands empower their producers to compliantly communicate, share, and sell on their social channels of choice. Denim Social partners with forward-thinking marketing teams in regulated industries including banking, mortgage, insurance and wealth management. The social selling platform is used by corporate level admins and local producers to amplify brand messaging and power sales on social media. For more information, visit DenimSocial.com.

About LumenVox

LumenVox is an industry-leading provider of speech-enabling software, bringing the power of voice to customers worldwide and facilitating billions of customer interactions. The LumenVox software portfolio consists of Automatic Speech Recognition (ASR) with transcription, Call Progress Analysis (CPA), Voice Biometrics, and Text-to-Speech (TTS). Designed to be highly flexible, accurate, and scalable, LumenVox helps some of the world’s largest cloud-first companies reimagine customer engagement by delivering exceptional voice experiences. LumenVox also provides self-service tools that enable customers to easily tune, adjust, and create language models. For more information, visit LumenVox.com.

*This article was originally published in PRNewswire.

Every social circle contains a few people whose ideas seem to carry more weight and gravitas. These people are influencers. They just seem to know what they’re talking about, and others actively seek their thoughts and opinions.

The same goes for digital social circles. If loan officers from your institution can establish themselves as thought leaders—specifically in loan origination—they can become sought-after sources for financial advice. Thought leadership demonstrates to readers that the person is knowledgeable and trustworthy, which will influence current and prospective clients.

When done right, a thought leadership strategy can be incredibly impactful. In a 2021 LinkedIn-Edelman survey, 65 percent of respondents said a piece of thought leadership content changed their perception of a company for the better, and 64 percent said thought leadership is a more trustworthy basis for gauging capabilities and competencies than marketing materials and product sheets. For banks especially, financial services thought leadership is a powerful way to foster trust and rapport with prospective clients.

The combination of thought leadership and social media augments these effects considerably. Unfortunately, banks tend to use social channels solely for marketing purposes and basic customer service.

Social selling is the use of social media to sell a product or service. It leverages social channels to build personal relationships, showcase thought leadership, engage with prospects, interact with existing customers and ultimately build sales-encouraging trust and rapport. It’s not enough to just “be online;” social selling empowers loan officers to become thought leaders, share with their networks and add humanity and authenticity to branded content.

Why should social selling techniques matter to your bank?

There’s a lot of bad financial advice online. Building thought leadership (especially in finance) allows loan officers to demonstrate that they are trusted, credible experts with clients’ best interests at heart. Prospective clients want to know they can trust your loan reps as human beings. Providing helpful, educational content is a great way to show them your business cares about delivering real value and connection. As a marketer for your brand, it’s your job to empower loan officers to start building those relationships through social selling.

Here are three tips for how to leverage social selling in your bank’s thought leadership strategy:

1. Build trust with prospects

Finance is a deeply personal business, and prospects want to know they can trust loan officers before feeling comfortable talking financial situations and goals. Social selling allows the brand’s loan officers to build direct, personal relationships with customers and prospects.

In times of market volatility or transition within a client’s life, the right thought leadership strategy can really connect. For instance, a blog post or LinkedIn video about debt consolidation loans could resonate with prospective clients who need help organizing their expenses. Or a reassuring Instagram reel about taking out a mortgage in a time of rising interest rates could be just what a first-time homebuyer needs to hear. Empowering your officers to start building these relationships via social selling content is one of your most important jobs in marketing for a banking brand.

2. Stay top of mind with clients

Financial services thought leadership helps your bank stay top of mind and engaged with existing clients. While there aren’t enough hours in the day for your brand’s loan officers to check in with every single client, social selling techniques can help them stay connected and deepen relationships without overworking. Social selling content can provide value to customers while loan officers are doing other vital work to close more loans.

Plus, when marketers help loan officers continually demonstrate their expertise online, the chances of gaining client referrals just increases. For example, offering services for business owners might encourage a social seller to post a guidebook about business loans and prompt an existing client to consider a loan to cover expansion. This guidebook can then serve as a handy piece of content for referrals.

3. Help intermediaries build expertise

While it’s not easy to confront, there is significant personnel movement in every industry today. Loan officers are concerned about their long-term career plans, and thought leadership is a great way to build your team’s reputation—regardless of where they work. Thought leadership content retains its value, even if employees move to another bank or financial institution. You might not be able to allow them to take their book of business, but their expertise and social media networks are intangible.

For these reasons (and more), thought leadership is essential to remaining competitive in today’s marketplace and building trust with clients. By leveraging social selling for loan officers, you’ll amplify your brand-building efforts with prospective clients, other industry experts and even potential employees. A solid thought leadership strategy through social selling will help build brand recognition, support lending teams, and establish lending officers as industry experts. Don’t wait to get started.

This article was originally published in ABA Banking Journal.

Personalization isn’t new to marketing. The process of connecting with customers has been moving in that direction for years, and for good reason. One survey found that 80% of respondents would be more likely to do business with companies that offered personalized experiences. But it seems many financial institutions haven’t yet gotten the news.

If you dig through the numbers, you’ll find that personalization applies to the financial industry. In fact, 72% of consumers rate personalization as highly important in finance. They value text alerts, customized tasks and opportunities to transact more efficiently. They also want digitally driven features that save them time with routine tasks and the ability to track multiple accounts using a single dashboard.

Financial marketers’ job is figuring out how to use personalization to gain (and retain) customers — and how to get leadership to buy in. It’s an easy sell: Personalization enhances the customer experience and also helps teams use social media marketing budgets more efficiently.

But financial marketers are often up against a knowledge gap. Senior management doesn’t always understand a digital-first strategy focused on personalization. Financial institutions historically aren’t known to be early adopters or quick to change, which can leave marketers spending years advocating for updates.

The question is, how exactly do you get buy-in from leadership to start personalizing and investing more money for social media marketing. The following strategies can help you get started:

Target the right people: Social media marketing is about identifying target audiences and catering strategies accordingly. The same applies when securing your social media marketing budget. When looking for buy-in, target those on the leadership team who are likely to understand what excellence in personalization looks like.

Great personalization is omnichannel; it engages consumers on the channels of their choice and it’s deeply human. To humanize marketing beyond the brand level, financial institutions need to reach out to leaders who would be open to highly personalized tactics such as social selling, which puts employees and producers on the frontlines to build relationships for the brand.

Craft the right message: Messaging is critical in marketing — and that goes double for selling the idea of a more personalized social strategy. Your message needs to resonate with your audience, even if your audience is one decision-maker. Link everything back to ROI by explaining that customers weigh bank reputation and online presence when deciding among financial institutions.

Be prepared to explain how you’ll track and increase customer conversion metrics through your campaigns. When arguing for more money toward paid social media advertising, for example, you’ll want to explain how it can boost conversion rates, meaning more customers (and revenue) coming in from your ads. Framing your message in business terms will help you advocate for funds to support personalization at scale.

Present the right data: Use compelling data to bring your message home. With 75% of B2B buyers using social media to make buying decisions, social selling is powerful for attracting new customers. But it’s important to understand whether your customers want to talk to your brand. Your audience is likely more comfortable engaging with brand intermediaries instead; people buy from other people.

That’s why so many financial institutions find it valuable to launch social selling programs that position agents, advisors and loan officers to build customer relationships. Social media is thick with prospects, as 54% today use social networks to conduct product research. Your team can capture prospects where they are with the right strategies, processes and technology.

Decide the right timing: The time to start advocating for personalization is now. Approach leadership about earmarking money for personalization in the budget for social media marketing.

Remember that most financial institutions establish their fiscal budgets for the year and often don’t revisit those budgets for another year. 41% of marketing budgets are based on the previous year, with only 10% revisited quarterly, meaning you should plan ahead for social initiatives that might take more money down the line. You likely won’t get another chance to advocate for that money once the budget is set.

Personalized relationships matter, and it’s time to make the case for an expanded marketing budget to support better personalization. With any marketing strategy, you want to approach the right audience with the right message at the right time. Then, with funds secured, your team can get to the exciting part: attracting prospects with education, keeping customers engaged with personalized messaging, and driving bottom-line impacts.

*This article was originally published in BAI.

Connect & Convert on Social

What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale

Omnichannel marketing addresses the customer’s individual needs during each step of the journey. But undertaking personalization for every customer is a Herculean task, so it needs to be automated and streamlined. This can be more basic, such as setting up newsletters to nurture leads that are automatically sent out at regular intervals, but it doesn’t have to be. The right tools can create connections between your digital marketing strategies and CRM records and automatically keep each other updated.

You also need to consider regulatory compliance with social media posts. A proper social media manager should screen posts for you, flagging any that may contain non-compliant content. Social selling relies on empowering intermediaries to connect with customers directly, so having a good management software in place to oversee all this activity is essential. Technology allows for omnichannel marketing in banks of all sizes. The more tasks you can automate, the more time you allow for higher-level responsibilities.

Omnichannel marketing is a highly effective strategy, but only if it’s implemented wisely. By using technology to their advantage, banks can target a multitude of audiences, allowing for greater reach and more conversions. Effectively utilizing paid ads and understanding how omnichannel allows for more personalized messaging will keep your bank ahead of competitors.

This article was originally published in ABA Bank Marketing.

What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale

Omnichannel marketing addresses the customer’s individual needs during each step of the journey. But undertaking personalization for every customer is a Herculean task, so it needs to be automated and streamlined. This can be more basic, such as setting up newsletters to nurture leads that are automatically sent out at regular intervals, but it doesn’t have to be. The right tools can create connections between your digital marketing strategies and CRM records and automatically keep each other updated.

You also need to consider regulatory compliance with social media posts. A proper social media manager should screen posts for you, flagging any that may contain non-compliant content. Social selling relies on empowering intermediaries to connect with customers directly, so having a good management software in place to oversee all this activity is essential. Technology allows for omnichannel marketing in banks of all sizes. The more tasks you can automate, the more time you allow for higher-level responsibilities.

Omnichannel marketing is a highly effective strategy, but only if it’s implemented wisely. By using technology to their advantage, banks can target a multitude of audiences, allowing for greater reach and more conversions. Effectively utilizing paid ads and understanding how omnichannel allows for more personalized messaging will keep your bank ahead of competitors.

This article was originally published in ABA Bank Marketing.

Read this guide if you’re asking yourself:

- Is my social media policy current and comprehensive?

- How do I ensure social media compliance during M&A?

- What do I need to consider for direct messaging compliance?

In this guide we will help you think about your all important social media policy and thoughtfully consider how changes in social media tech and even your bank’s structure may impact compliance.

Which roles do you fill when building your bank's marketing dream team? This guide will show you the following:

- Who does what

- The right structure to execute strategy

- How compliance software can help

Enjoy!

It’s no surprise that social media can help drive results for your mortgage business. In fact, the question for most marketers at mortgage lending institutions isn’t IF they should be doing more social media marketing - it’s HOW. Download to learn how to:

- Scale your social selling program

- Plan your content strategy

- Train your loan officers

Like many community banks, Dart Bank wanted to keep customer relationships a top priority. This meant being more available to customers and meeting them where they are. In modern terms, that means on social media.

When Dart Bank learned about how Denim Social supports social selling for loan officers, they knew it was the perfect fit to keep their team engaged at every step of the journey. They wanted to empower their loan officers to create and grow authentic relationships online, never missing an opportunity to connect.

Shelter Insurance® sought to launch a social selling program that would not only create posting efficiency, but also make it easy for agents to establish subject matter expertise via high quality social media content. They also saw an opportunity to empower digitally savvy agents to cultivate leads online to drive business results in a compliant social selling program.

Before launching the program, it was essential that agents understood the pillars of social selling. Together with the Denim Social team, Shelter Insurance® developed a best-in-class program communication, onboarding and training process for agents.

Social selling is just what it sounds like: using social media to sell a product or service. It’s leveraging social to build personal relationships, showcase thought leadership, engage with prospects, interact with existing customers, and ultimately build trust and rapport that will eventually lead to sales.

It enables intermediaries – like insurance agents – to add value to the customer journey where there wouldn’t otherwise be an opportunity.

This guide will help financial services marketers understand why social media should be a core component of their marketing strategy and showcase how the collective reach of their intermediaries’ social media presence can be harnessed to more deeply connect with prospective clients, position producers as thought leaders in their communities, and, ultimately, build trust with clients that translates to positive business results.

It’s called social selling and it works.

The spring 2023 buying season has arrived and with it – you guessed – uncertainty. Spring has long been make-it or break-it season for lenders and loan officers, and despite present conditions, the same holds true this year. But 2023 holds unique challenges and opportunities.

As the season opens, there are a few key considerations the Denim Social team sees as critical for mortgage marketers.

Paid social is one of the most effective ways to introduce people who aren’t yet following your producers, agents, loan officers, or advisors to your financial institution at the right place and the right time.

Paid social is complementary to organic. While organic social builds first-degree connections and facilitates awareness, engagement, and branding, paid social allows you to reach larger, more tailored audiences.

BOK Financial is a financial services partner for consumers, businesses and wealth clients with more than 150 users on the Denim Social platform.

In addition to building brand credibility and establishing loan officer expertise, Denim Social enables their mortgage loan officers to cultivate relationships in social media and organically source leads.

As financial marketers look to the coming year, most are wondering, “what’s next?” While no one can say for sure, our team of experts here at Denim Social are keeping a pulse on what’s new in digital marketing for financial institutions on social media. This guide will not only educate you on the latest trends, but help you make the case for increased investment in social selling and digital marketing strategies at your institution.

Evolve Bank & Trust (“Evolve”) is an $700M+ asset institution with nearly 40 Home Loan Centers (HLC) and nearly 500 employees nationwide. See how Denim Social helped Evolve activate Home Loan Center Facebook pages over the course of just a few months.

Whether you’re in banking, wealth management, insurance or mortgage, relationships are the bedrock of your business.

Considering clients in these industries are handing over the keys to their personal kingdoms, it’s no surprise that trust and connection matter. That’s why successful sales strategies for these industries are focused on building long-term, trusted relationships.

To truly unleash the potential of social, financial institutions need to use social media as a sales tool. It’s called social selling and it works.

The power of social media is undeniable. The ability of banks to engage with and influence customers and prospects via interactive digital channels is an essential tool and a cornerstone of marketing. Gone are the days when it was “nice to have” a presence on platforms such as Facebook, LinkedIn, Twitter and Instagram. Today, these pathways are helping banks to build relationships that were historically cultivated by tirelessly walking up and down Main Street, shaking hands and leaving behind business cards.

In this case study by Denim Social and American Bankers Association, we take a look at how banks are using social media to ramp up digital engagement and build sales.

As any marketer worth their salt will tell you, analytics should drive your social strategy. The key to success is understanding how to link social media efforts to ROI metrics. Read this guide to learn how to gain insights that matter, optimize your strategy and prove your social success.

AnnieMac is one of the fastest-growing mortgage loan providers in the U.S., serving clients in 42 states. Learn how Denim Social helped their team to streamline its brand’s social media strategy and activate social selling for hundreds of loan officers in just four months.

As mortgage demand surges to historic highs, home purchase and refinance markets remain hot. This is excellent news for loan officers, but it also means the environment is more competitive than ever.

So how can marketers ensure that their loan officers stand out? The answer is social media.

Read this guidebook from Denim Social to learn how you can help your loan officers build strong relationships, stand out from the crowd and win more business using social media.

Every Mortgage Marketer Should Ask Themselves

Compliance is complicated, but don’t let it stop your lending team from making the most of social media. Think you’re ready to start social selling? Ask yourself these five questions!

Every Financial Services Marketer Should Ask Themselves

Compliance is complicated, but don’t let it stop your lending team from making the most of social media. Think you’re ready to start social selling? Ask yourself these five questions!

Stronger Customer Relationships on Instagram

Financial Services companies should be marketing and advertising on Instagram. We break down why, and help you create a strategy to reach new customers- while continuing to build trust in your brand.

How 6 Financial Marketers Are Creating Value in Social Media

Ever wonder what everyone else is doing in social media? We talked to six leading financial marketers about how they’re succeeding today and planning for the next big thing.

Get their insights on strengthening your social strategies, unlocking the power of employee networks and creating next-level content that drives engagement.

Download this guidebook to learn how 3 mortgage lenders are using social media to:

- Position themselves in a place the community is already looking ... their social media

- Empower loan officers to engage in local conversations

- Turn their institution's loan officers into the voice of their brand

- Build trust within the community

ABA Study: The Current State of Social Media

See what nearly 430 bank marketers had to say when asked questions such as:

COVID-19 & Bank Social Media

Times are different and how you connect with customers and potential customers has changed drastically. In a socially distant world, learn to still build lasting relationships.

Download and learn the guiding principles for using social media to serve both your customers and communities in the midst of a pandemic.

What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale

Omnichannel marketing addresses the customer’s individual needs during each step of the journey. But undertaking personalization for every customer is a Herculean task, so it needs to be automated and streamlined. This can be more basic, such as setting up newsletters to nurture leads that are automatically sent out at regular intervals, but it doesn’t have to be. The right tools can create connections between your digital marketing strategies and CRM records and automatically keep each other updated.

You also need to consider regulatory compliance with social media posts. A proper social media manager should screen posts for you, flagging any that may contain non-compliant content. Social selling relies on empowering intermediaries to connect with customers directly, so having a good management software in place to oversee all this activity is essential. Technology allows for omnichannel marketing in banks of all sizes. The more tasks you can automate, the more time you allow for higher-level responsibilities.

Omnichannel marketing is a highly effective strategy, but only if it’s implemented wisely. By using technology to their advantage, banks can target a multitude of audiences, allowing for greater reach and more conversions. Effectively utilizing paid ads and understanding how omnichannel allows for more personalized messaging will keep your bank ahead of competitors.

This article was originally published in ABA Bank Marketing.

Read this guide if you’re asking yourself:

- Is my social media policy current and comprehensive?

- How do I ensure social media compliance during M&A?

- What do I need to consider for direct messaging compliance?

In this guide we will help you think about your all important social media policy and thoughtfully consider how changes in social media tech and even your bank’s structure may impact compliance.

Which roles do you fill when building your bank's marketing dream team? This guide will show you the following:

- Who does what

- The right structure to execute strategy

- How compliance software can help

Enjoy!

It’s no surprise that social media can help drive results for your mortgage business. In fact, the question for most marketers at mortgage lending institutions isn’t IF they should be doing more social media marketing - it’s HOW. Download to learn how to:

- Scale your social selling program

- Plan your content strategy

- Train your loan officers

Like many community banks, Dart Bank wanted to keep customer relationships a top priority. This meant being more available to customers and meeting them where they are. In modern terms, that means on social media.

When Dart Bank learned about how Denim Social supports social selling for loan officers, they knew it was the perfect fit to keep their team engaged at every step of the journey. They wanted to empower their loan officers to create and grow authentic relationships online, never missing an opportunity to connect.

Shelter Insurance® sought to launch a social selling program that would not only create posting efficiency, but also make it easy for agents to establish subject matter expertise via high quality social media content. They also saw an opportunity to empower digitally savvy agents to cultivate leads online to drive business results in a compliant social selling program.

Before launching the program, it was essential that agents understood the pillars of social selling. Together with the Denim Social team, Shelter Insurance® developed a best-in-class program communication, onboarding and training process for agents.

Social selling is just what it sounds like: using social media to sell a product or service. It’s leveraging social to build personal relationships, showcase thought leadership, engage with prospects, interact with existing customers, and ultimately build trust and rapport that will eventually lead to sales.

It enables intermediaries – like insurance agents – to add value to the customer journey where there wouldn’t otherwise be an opportunity.

This guide will help financial services marketers understand why social media should be a core component of their marketing strategy and showcase how the collective reach of their intermediaries’ social media presence can be harnessed to more deeply connect with prospective clients, position producers as thought leaders in their communities, and, ultimately, build trust with clients that translates to positive business results.

It’s called social selling and it works.

The spring 2023 buying season has arrived and with it – you guessed – uncertainty. Spring has long been make-it or break-it season for lenders and loan officers, and despite present conditions, the same holds true this year. But 2023 holds unique challenges and opportunities.

As the season opens, there are a few key considerations the Denim Social team sees as critical for mortgage marketers.

Paid social is one of the most effective ways to introduce people who aren’t yet following your producers, agents, loan officers, or advisors to your financial institution at the right place and the right time.

Paid social is complementary to organic. While organic social builds first-degree connections and facilitates awareness, engagement, and branding, paid social allows you to reach larger, more tailored audiences.

BOK Financial is a financial services partner for consumers, businesses and wealth clients with more than 150 users on the Denim Social platform.

In addition to building brand credibility and establishing loan officer expertise, Denim Social enables their mortgage loan officers to cultivate relationships in social media and organically source leads.

As financial marketers look to the coming year, most are wondering, “what’s next?” While no one can say for sure, our team of experts here at Denim Social are keeping a pulse on what’s new in digital marketing for financial institutions on social media. This guide will not only educate you on the latest trends, but help you make the case for increased investment in social selling and digital marketing strategies at your institution.

Evolve Bank & Trust (“Evolve”) is an $700M+ asset institution with nearly 40 Home Loan Centers (HLC) and nearly 500 employees nationwide. See how Denim Social helped Evolve activate Home Loan Center Facebook pages over the course of just a few months.

Whether you’re in banking, wealth management, insurance or mortgage, relationships are the bedrock of your business.

Considering clients in these industries are handing over the keys to their personal kingdoms, it’s no surprise that trust and connection matter. That’s why successful sales strategies for these industries are focused on building long-term, trusted relationships.

To truly unleash the potential of social, financial institutions need to use social media as a sales tool. It’s called social selling and it works.

The power of social media is undeniable. The ability of banks to engage with and influence customers and prospects via interactive digital channels is an essential tool and a cornerstone of marketing. Gone are the days when it was “nice to have” a presence on platforms such as Facebook, LinkedIn, Twitter and Instagram. Today, these pathways are helping banks to build relationships that were historically cultivated by tirelessly walking up and down Main Street, shaking hands and leaving behind business cards.

In this case study by Denim Social and American Bankers Association, we take a look at how banks are using social media to ramp up digital engagement and build sales.

As any marketer worth their salt will tell you, analytics should drive your social strategy. The key to success is understanding how to link social media efforts to ROI metrics. Read this guide to learn how to gain insights that matter, optimize your strategy and prove your social success.

AnnieMac is one of the fastest-growing mortgage loan providers in the U.S., serving clients in 42 states. Learn how Denim Social helped their team to streamline its brand’s social media strategy and activate social selling for hundreds of loan officers in just four months.

As mortgage demand surges to historic highs, home purchase and refinance markets remain hot. This is excellent news for loan officers, but it also means the environment is more competitive than ever.

So how can marketers ensure that their loan officers stand out? The answer is social media.

Read this guidebook from Denim Social to learn how you can help your loan officers build strong relationships, stand out from the crowd and win more business using social media.

Every Mortgage Marketer Should Ask Themselves

Compliance is complicated, but don’t let it stop your lending team from making the most of social media. Think you’re ready to start social selling? Ask yourself these five questions!

Every Financial Services Marketer Should Ask Themselves

Compliance is complicated, but don’t let it stop your lending team from making the most of social media. Think you’re ready to start social selling? Ask yourself these five questions!

Stronger Customer Relationships on Instagram

Financial Services companies should be marketing and advertising on Instagram. We break down why, and help you create a strategy to reach new customers- while continuing to build trust in your brand.

How 6 Financial Marketers Are Creating Value in Social Media

Ever wonder what everyone else is doing in social media? We talked to six leading financial marketers about how they’re succeeding today and planning for the next big thing.

Get their insights on strengthening your social strategies, unlocking the power of employee networks and creating next-level content that drives engagement.

Download this guidebook to learn how 3 mortgage lenders are using social media to:

- Position themselves in a place the community is already looking ... their social media

- Empower loan officers to engage in local conversations

- Turn their institution's loan officers into the voice of their brand

- Build trust within the community

ABA Study: The Current State of Social Media

See what nearly 430 bank marketers had to say when asked questions such as:

COVID-19 & Bank Social Media

Times are different and how you connect with customers and potential customers has changed drastically. In a socially distant world, learn to still build lasting relationships.

Download and learn the guiding principles for using social media to serve both your customers and communities in the midst of a pandemic.

What does omnichannel marketing look like for banks?

Banks that do not adapt to the digital world are leaving opportunities on the table. Organic social media is a great way to build a brand and awareness, but that is only a fraction of the potential that lies in fully integrated digital marketing. Banks that utilize omnichannel marketing create a seamless experience regardless of where leads are engaged and wherever they are in the buyer’s journey.

Omnichannel bank marketing is the future—bank marketers meeting people on the channel of their choice, and that means investing in social media. Most customers do not operate off a singular social channel. Rather, financial institutions win when they provide a seamless experience to customers across multiple social platforms in order to maximize their social marketing strategies.

Organic social media is great for creating awareness, but institutions need to be more purposeful in content engagement, consideration, and conversion stages. Rates are not what drive customers to change their financial institution. Emotions are more likely to be the impetus. This is why personalization in digital bank marketing is such a necessity.

There are four crucial steps to take to avoid falling behind the curve while answering the question: What does omnichannel marketing look like for banks?

1. Use paid advertising to engage your audience

Organic content is the foundation of a good social selling marketing strategy, but algorithms will often work against you. Paid social media advertising ensures your content makes it in front of the right eyes.

There is another benefit to going the paid route: Organic reach is often limited to those who are already aware of your institution in some capacity. Paid advertising lets you reach previously untapped audiences and guide them toward the top of your marketing funnel.

To increase your chances of success, use intelligent targeting to focus your ads on the customer’s specific needs. Paid advertising allows for extremely specific targeting, which should be factored into your strategy. Ads for first-time homebuyer mortgages should be in front of those 20- and 30-somethings looking into housing, while retirement ads are better off with the 55+ crowd. The best marketing in the world won’t work if it’s at the wrong time in the wrong place. Identify where in the funnel customers are and target them (on their preferred platform!) with paid advertisements tailor-made to their current need.

2. Guide the audience’s next steps

Social media marketing is just a singular step in a larger walk, so make sure you leave breadcrumbs for leads to follow. Social reach means little if you’re not actually creating conversions. Regardless of whether you use organic posts or paid, don’t forget to include some form of landing page to guide readers back to your brand’s website. There should be no “digital dead ends” in your social strategy. Every piece of the puzzle should connect your audience to another way to engage.

When deciding what landing page to use, curate the page to the post. If your advisor is posting about retirement funds, link to a specific ebook on the subject. Gated content will educate the customer while also providing you with the information needed to start nurturing a lead. It’s a win-win situation.

3. Retarget to convert and retain

Once customers have engaged with your institution, retain that data to inform future interactions, i.e., use retargeting to your advantage by connecting with consumers based on previous engagements. Sometimes, customers may need a nudge to close the conversion. Make sure your marketing allows for that. The right CRM tools will guide retargeting efforts by notifying customers ripe for retargeting. They can also automate messages to send out to your audience, such as email drip campaigns, making sure you reach out at just the right time.

Even after you’ve converted a lead, don’t stop nurturing. The customer journey is cyclical, and new customers will eventually become brand ambassadors in their own right if you give them an experience warranting it. You’ll retain loyal customers and potentially gain references through them.

4. Use technology to scale